· 5 min read

Crypto’s Double-Edged Sword - Navigating Strengths, Weaknesses, and the Noise

Cryptocurrencies have evolved from a niche technology into a global phenomenon, sparking widespread debate but also presenting unique challenges beyond typical criticisms.

The Double-Edged Sword of Crypto: Diversity, Oversaturation, and the Fight for Clarity

In the past decade, cryptocurrencies have shifted from niche technology to a global phenomenon. They’ve sparked debates across financial, technological, and even philosophical spheres. Yet, as transformative as crypto can be, it’s also a space fraught with challenges—and not just the ones critics typically harp on.

The Power of Diversity in Crypto Projects

One of crypto’s greatest strengths is its diversity. Thousands of projects have emerged, each addressing different problems, proposing new solutions, or reimagining existing systems. From Bitcoin’s ambition to serve as digital gold to Ethereum’s promise as a decentralized application platform, the ecosystem’s breadth is unparalleled. Other projects explore niche applications like supply chain tracking, identity verification, or even tokenized real estate.

This diversity creates a rich ecosystem where innovation thrives. It’s a mark of a healthy system: multiple approaches to problems mean no single point of failure. If one technology falters, others might succeed, offering resilience and adaptability. However, this strength is also a weakness.

Oversaturation and the Confusion Problem

The explosion of crypto projects has led to oversaturation. With thousands of coins, tokens, and protocols competing for attention, it’s hard to distinguish the groundbreaking from the redundant. Many projects aim to solve similar problems, but with slightly different angles, governance models, or promises of efficiency.

For example, consider the flood of decentralized finance (DeFi) platforms. While competition can drive innovation, it also leads to fragmentation and confusion. Users and investors struggle to identify trustworthy platforms amidst the noise. Worse, malicious actors exploit this confusion, launching scams or projects built on empty promises.

This environment of oversaturation doesn’t just hurt consumers; it hampers adoption. When potential users are bombarded with jargon, overlapping features, and unclear value propositions, many choose to stay out entirely.

Transparency, Hype, and Misinformation

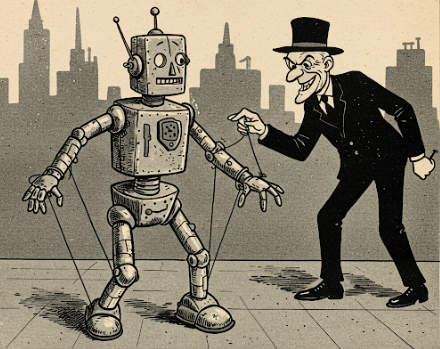

Another significant issue in crypto is the gap in clear and honest communication. At the same time, some players in the space rely heavily on hype, creating “smoke and mirrors” to mask technical or governance flaws. For instance, marketing campaigns often boast “revolutionary” solutions without explaining the underlying technology, setting unrealistic expectations and leading to inevitable disappointment when promises fall short.

Marketing campaigns often highlight “revolutionary” solutions without providing clear explanations of the actual technology, leading to disillusionment when expectations clash with reality. In an age dominated by social influence, where everyone is vying for attention, this creates a relentless “war of escalation” to outdo competitors. The pressure to stand out fuels a cycle of overpromising and underdelivering, which has, unfortunately, become commonplace. While such tactics might win short-term attention, they contribute to long-term frustration and skepticism, further muddying the waters in an already complex space.

Misinformation also runs rampant, often amplified by social media, which thrives on sensationalism. Wild claims about guaranteed returns or the inevitability of mass adoption often intertwine with the over-saturation of crypto projects, compounding the confusion for users. These exaggerated narratives obscure the genuine potential of blockchain technology and feed into the skepticism created by an already crowded and chaotic ecosystem. These narratives invite skepticism and erode trust, even among projects with strong fundamentals.

At the same time, let’s not lay the blame solely on bad actors. The crypto industry itself struggles with effective communication. Blockchain technology is complex, and its nuances aren’t always easy to distill for a general audience. The result is a communication gap that allows misconceptions to flourish, such as the belief that blockchain can solve every problem or that cryptocurrencies are exclusively speculative assets. These misconceptions not only shape public opinion but also create barriers to understanding the true potential and limitations of the technology.

Crypto’s Unrealized Potential

Despite these challenges, the potential of cryptocurrencies and blockchain technology remains immense. Decentralized networks offer new ways to manage trust, reduce reliance on intermediaries, and empower individuals in ways traditional systems cannot. Crypto can enable financial inclusion, protect digital identities, and even combat censorship.

But realizing this potential requires addressing its weaknesses. Transparency must become a priority, with projects committing to clear, honest communication about their goals, limitations, and governance. The industry needs to self-regulate against misinformation and hype, holding bad actors accountable to protect its credibility.

Additionally, user education is critical. Simplifying the onboarding process and bridging the gap between crypto’s potential and everyday usability are essential. Current efforts to integrate crypto into daily life often feel clunky compared to the seamless experiences offered by contactless payments or wallets like Apple Pay, Google Wallet, and PayPal. For crypto to gain traction with the average consumer, its utility must become as natural and painless as these familiar tools. Removing the friction from transactions, improving wallet designs, and ensuring compatibility with existing payment systems could significantly boost adoption and acceptance.

The Path Forward

Crypto’s diversity and innovation are its lifeblood, but they also make it vulnerable to over-saturation, misinformation, and hype. For the technology to fulfill its promise, stakeholders must address these challenges head-on. This means fostering a culture of transparency, encouraging collaboration over competition, and committing to educating users.

While the path ahead is uncertain, one thing is clear: the transformative potential of crypto is too significant to ignore. By learning from its weaknesses and amplifying its strengths, the industry can build a future that’s as impactful as its early advocates envisioned.